DROP IN LOANS AT REGIONAL BANKS

Why Would This Be Happening In The Optimism Of The Trump Era?

It appears to be somewhat of a wait and see attitude with the regional banks.

Corporations and small businesses are waiting for details on the Trump Administration’s proposals and results before seeking financing for expansion.

Complete stats in this Bloomberg article below:

Trump Era Brings Rare Drop in Loans at America’s Regional Banks

By Jennifer Surane

April 27, 2017, 5:00 AM MSTAlmost every major regional bank misses estimates for lending

The 15 largest post their first drop in total loans since 2013For regional banks across the U.S., the “Trump bump” hasn’t yet translated into business.

Bank stocks have climbed since Donald Trump was elected president as investors bet his pro-growth agenda and rising interest rates would help lenders generate huge profits. But this month, executives at some of the country’s largest regional banks said customers, especially corporations and small businesses, are instead waiting for details on the new administration’s proposals and results before seeking financing for expansion.

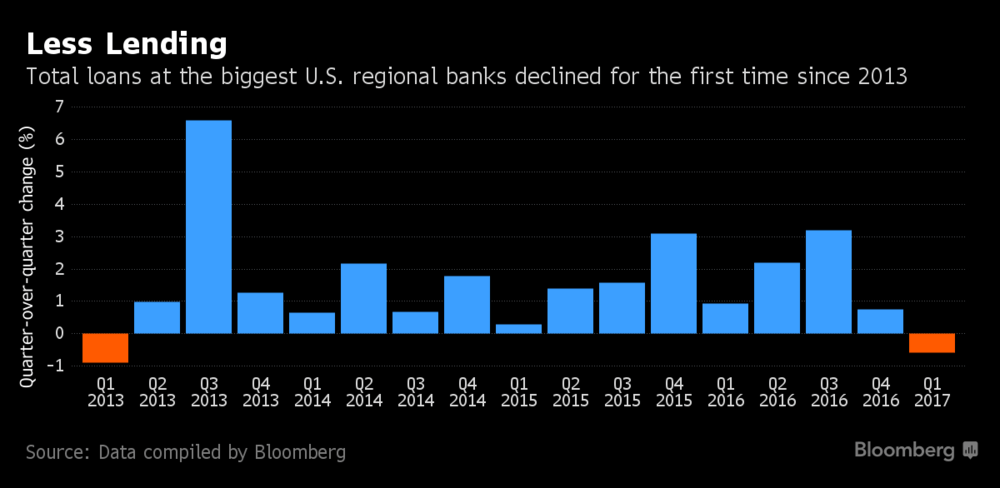

Drop In Loans At Regional Banks

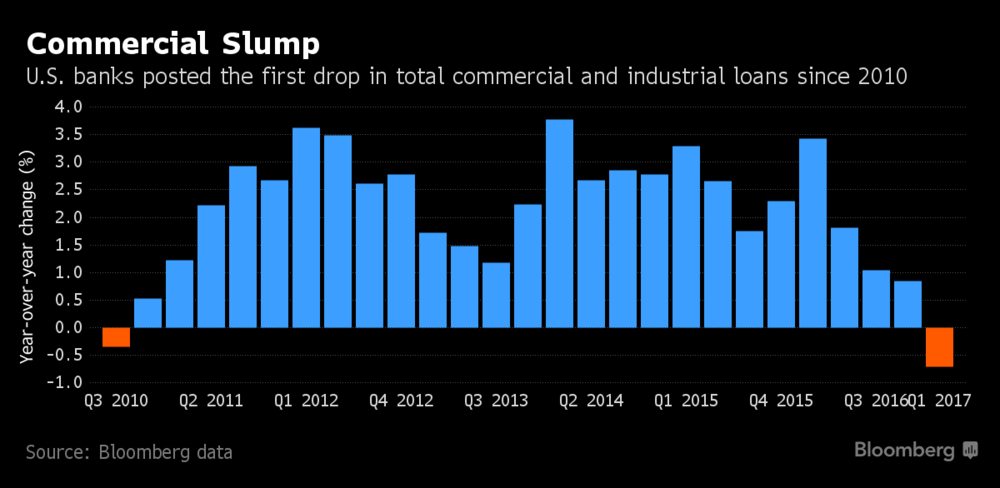

Total loans at the 15 largest U.S. regional banks declined by about $10 billion to $1.73 trillion in the first quarter, compared with the previous three-month period, the first such drop in four years, according to data compiled by Bloomberg. All but two of those banks missed analysts’ estimates for total loans, as a slump in commercial and industrial lending sapped growth.

“The optimism and the willingness is there, but it has not yet translated into actions or behaviors,” Beth Mooney, chief executive officer of KeyCorp, said of the Cleveland-based bank’s small and middle-market business clients. “We did not see ‘flip the switch’ sort of behavior that led to loan demand or making different capital decisions or investment decisions.”

The most important business stories of the day.Their view from Main Street contrasts with Wall Street, where global investment banks including JPMorgan Chase & Co., Bank of America Corp., Citigroup Inc. and Morgan Stanley announced jumps in earnings from fixed-income trading units that help big investors speculate on bonds, currencies and commodities. The irony is that some types of businesses broadly criticized during the presidential campaign are now profiting most.

The last of the 15 largest regional banks reported quarterly results Wednesday. Some said other developments also weighed on lending. They cited instances of clients turning directly to investors for financing, tapping into their optimism for growth under Trump. And many traditional retailers are struggling in the internet era.

Within commercial lending, big corporations have been reticent to take out new loans, instead tapping capital markets for their needs, said Terry Dolan, chief financial officer at Minneapolis-based U.S. Bancorp, the nation’s largest regional bank.

“We saw a number of our bigger customers go to the bond markets and issue debt and take out credit, so that was a factor” weighing on loan growth in the first quarter, said Citizens Financial Group Inc. CEO Bruce Van Saun, whose firm is based in Providence, Rhode Island. “The nice corollary to that is that our capital-markets fees are exploding.”

Manufacturers in the rust belt are drawing unprecedented inquiries from buyers overseas, said Stephen Steinour, CEO of Huntington Bancshares Inc., Ohio’s third-largest lender. Still, he said, “there’s an expectation that there’s going to be policy changes and those policy changes might have ramifications, so there’s a little bit of a wait and see going on here.”

Many regional lenders began to break out their exposure to retailers and the underlying real estate that supports it after investors and analysts voiced concerns about credit quality. The pace of store closings this year is already ahead of 2008, the most recent peak, according to an analysis by Credit Suisse Group AG.

“Retail is an industry that’s going through a secular change” as more people shop online, said Darren King, M&T Bank Corp.’s CFO. “How far it will go, and how fast it will go, and what the knock-on effects are remain to be seen.”

Drop In Loans At Regional Banks