Global Debt Is Exploding !!!

The Global Debt Will Have An Impact On The USA

Check out this article from Zerohedge.com which is noted for being ahead of the curve

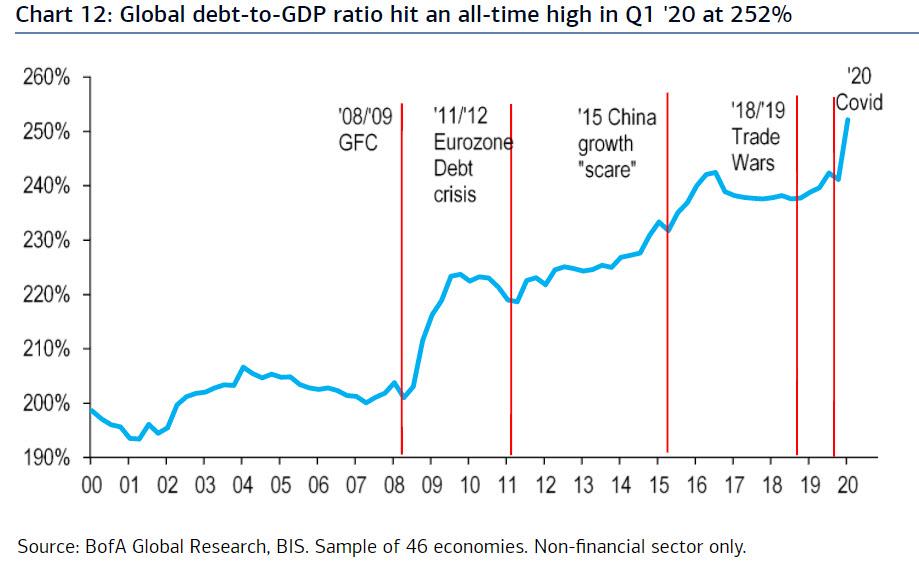

The primary reason why the global financial system is on the verge of daily collapse, and is only held together with monetary superglue and central bank prayers thanks to now constant intervention of central banks, is because of debt. And, as BofA’s Barnaby Martin succinctly puts it, much more debt is coming since “the legacy of the COVID shock is debt, debt and more debt.” In short: use even more debt to “fix” a debt probem.

So in this world of explosive credit expansion coupled with tumbling economic output where helicopter money has become the norm, central banks – and specifically the ECB – are scaling their QE policies to monetize and absorb much of this debt (relieving the pressure on private investors to buy bonds), more debt “hotspots” mean more vulnerabilities for the global economy.

We won’t preach about the consequences of this debt binge which has catastrophic consequences – we do enough of that already – but below we lay out some of the more stunning facts of global debt levels at the end of Q1 2020 as compiled by the BIS, courtesy of Martin:

- Global debt/GDP surged to an all-time high in Q1 ’20, with overall debt for the non-financial sector now worth 252% of global GDP. This is up from 241% at the end of 2019, the biggest quarterly jump ever according to BIS data.

The chart also confirms that central bank inflation targets are higher, much higher than the “”official 2%: to erase this debt, central banks needs inflation to be in the 10%+ range. Anything below that would require debt defaults instead of inflation to wipe away the debt… and that is unacceptable. - This increase reflects the fallout from the first few weeks of the COVID crisis, with most advanced economies implementing total or partial lockdowns in March. Hence, the historical contraction in GDP growth observed worldwide in Q2 and the debt surge from both governments and non-financial corporations will translate into an even bigger rise in the global leverage ratio in Q2 ’20.

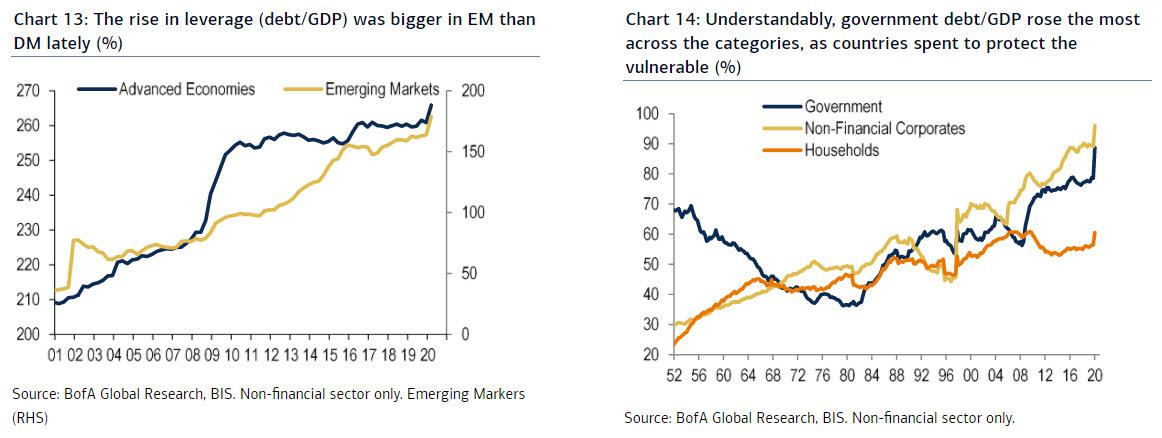

- Pre-existing vulnerabilities have been laid bare by the nature of the COVID shock. While both advanced economies (DM) and emerging markets (EM) have seen their leverage ratios jump, the latter have observed a rapid increase since 2012 (Chart 13). The relatively deeper COVID recession expected for some EM economies – the OECD Sep ‘2020 Economic Outlook sees India and South Africa GDP falling by 10.2% and 11.5%, respectively – will likely magnify the jump in some EM’s leverage ratios.

- By sectors, governments drove the big uptick in debt/GDP in Q1 ’20. The global sovereign debt-to-GDP ratio has reached 89%, up 10 percentage points, the largest quarterly rise on record.

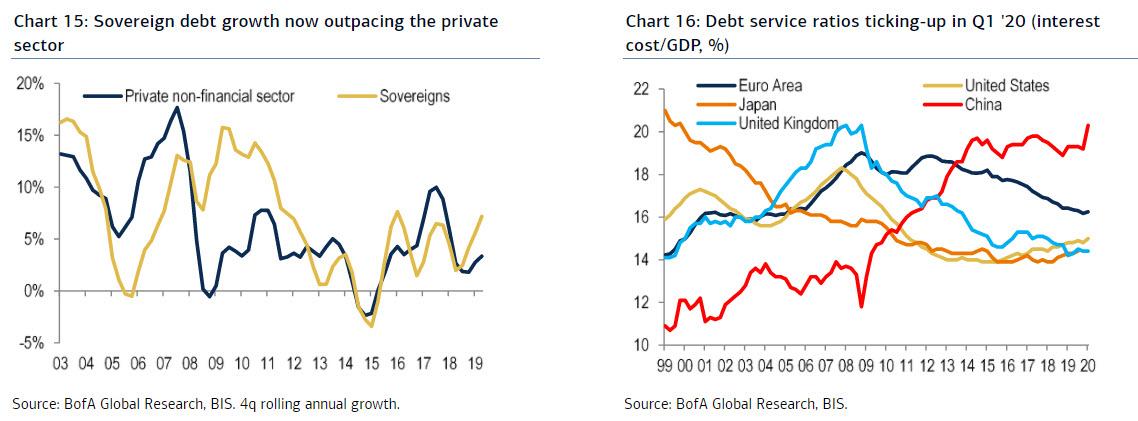

- Debt service ratios ticked up, but only marginally, reflective of the tremendous QE support unleashed by central banks this year.

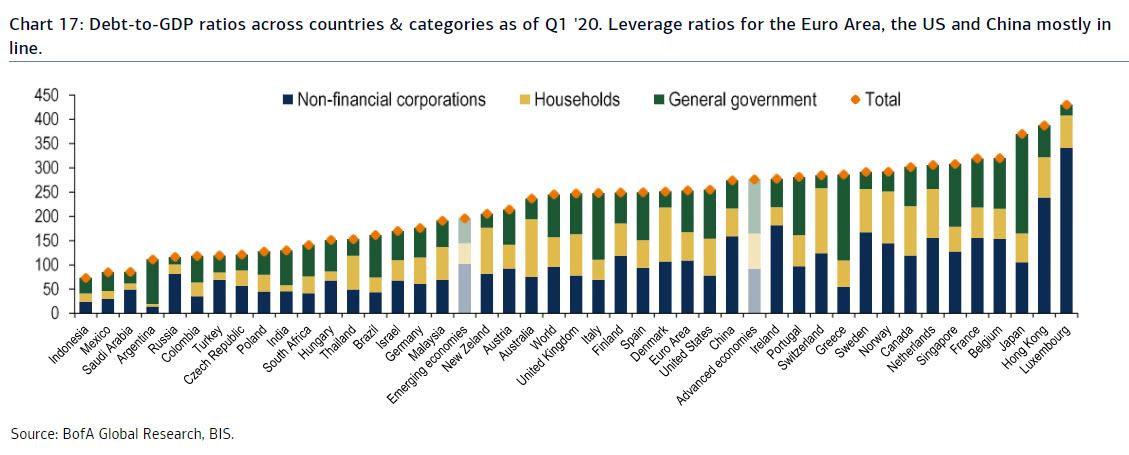

Total non-financial debt/GDP across countries and segments is shown in the BofA chart below; it shows that…

- The total leverage ratio for Euro Area, China and the US are mostly in line now;

- In Europe, a number of core countries (Belgium, Finland and Norway) saw a bigger increase in their total debt/GDP ratio than in the periphery in Q1 ’20;

- While the rise in household debt has generally been more modest as consumers have moved into wait-and-see mode, China household debt/GDP rose 3.1% QoQ in Q1 ’20

Finally, the table below show global debt/GDP leverage ratio across the globe, broken down by countries and segments.